Mohnish Pabrai, Founder and Managing Partner of the Pabrai Investments Funds

For students of history, especially the history of Berkshire Hathaway’s early days, Adam Mead’s book is a must read… It contains storied theft of intellectual property, occurring as early as 1789 when a certain Samuel Slater snuck out of England with knowledge of how to build a viable water-powered mill. It is a story of venture capital. “Financial backers in Pawtucket, Rhode Island” (including, none other than notorious financier, Hetty Green, a rich heiress to a new Bedford shipping fortune) provided venture capital funding for Slater’s business. It involves internet-like speedy growth, with 20 Slater-style mills dotting New England within just the first 20 years. Finally, it entails early versions of SPACs, then called “joint-stock corporations,” underwritten by wealthy Boston merchant, Francis Lowell. Adam commences his story with reference to an entrenched dominant nation, in this case England, worried about their loss of global standing to the upstart, United States, through both fair competition and through America’s use of stolen technology. Sound familiar?

| Publisher | Pan Macmillan |

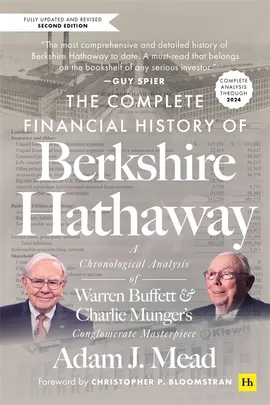

| Author | Adam J. Mead |

| Country | United Kingdom |

| Publication Date | 28/04/2026 |

| Pages | 880 |

| Edition | Second Edition |

| Size | 6×9 |

| About the Author | Adam J. Mead is a life-long student of business and capital allocation. He is the CEO and Chief Investment Officer of Mead Capital Management, LLC, a boutique investment management firm that employs proven value investing techniques and private ownership principles to the ownership of public companies. He is also the Founder of Watchlist Investing, a value investing newsletter on Substack and the author of The Complete Financial History of Berkshire Hathaway. |

| Publisher Address | webqueries@macmillan.co.uk |

| ISBN | 9781804093832 |